"Check with our tax department to ensure that your business is benefiting from the tax reliefs available to your business."

Capital Allowances

The current Capital Allowance legislation is changing rapidly and growing in complexity in the UK. It has never been more important to seek professional advice on how to maximise tax relief on capital expenditure.

Is a substantial portion of your businesses capital investment tied up in property? With our wealth of experience in property capital allowances, we can help your business realise the maximum tax relief available on your property acquisitions, construction and renovations.

With the new Structures and Buildings Allowances available for construction projects, commencing after October 2018, our tax department can help ensure you are not losing out.

Company vehicles are becoming a major source of expenditure for many businesses. Our team can advise you on how to maximise your Capital Allowance claim on company vehicle purchases.

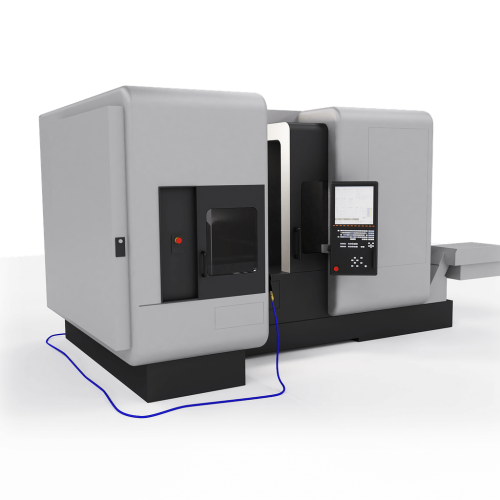

In a drive to encourage businesses to invest in energy-saving plant and machinery and low emission cars, the Enhanced Capital Allowance (ECA) scheme was introduced. 100% tax relief is currently available for eligible purchases.