Updated information as of 16th November 2020.

Furlough Scheme to remain open until 31st March 2021

On the 29th October we held a webinar on the new Job support scheme due to launch on 1st November 2020, yet a few days later a complete U-turn has been made.

Businesses can now continue to use the Coronavirus Job Support Scheme (CJRS) until 31st March 2021 with more generous rulings

Key Information

The level of the grant will mirror levels available under the CJRS in August, so the government will pay 80% of wages up to a cap of £2,500 and employers will pay employer National Insurance Contributions (NICs) and pension contributions only for the hours the employee does not work.

- The scheme is now open until 31st March 2021.

- In addition to the full-time furloughing, flexible furlough will also be allowed.

- Employees eligible have been extended to include those on the payroll as at 30th October 2020 and they don’t have to have been furloughed previously.

- Businesses can now rehire and furlough staff they've made redundant and those who've left voluntarily.

The government has advised that further details, including how to claim this extended support through an updated claims service, will be provided shortly once they have had the chance to update the legislation.

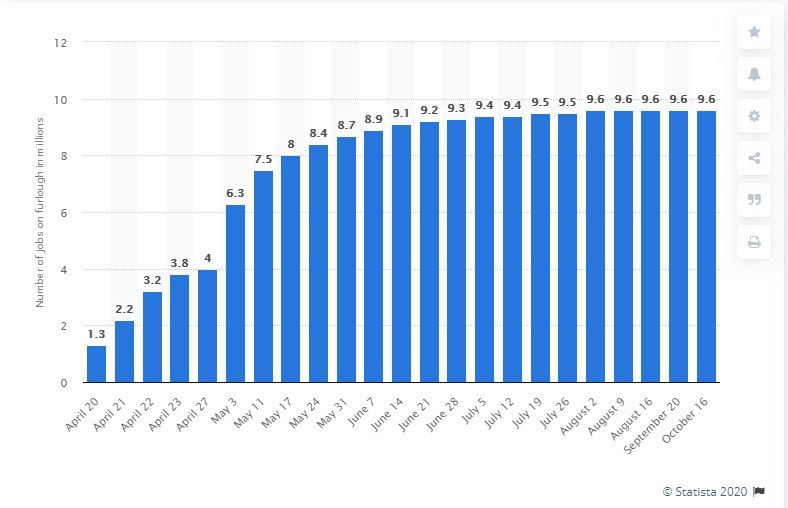

Current furlough statistics

As of October 18th 2020 the HMRC coronavirus (COVID-19) statistics are as follows:

- 9.6 million jobs furloughed

- 1.2 million employers have furloughed employees

- 41.4 billion pounds claimed

If we prepare your payroll our payroll department will be in touch shortly once we have firm details from HMRC.

If we do not prepare your payroll please don’t hesitate to contact us, we can help you with your claim.

Find out how Pierce has helped businesses such as Edward Taylor Textiles to retain valued and skilled staff by utilising the above Furlough Scheme.