Autumn Budget 2021: How will it impact your business?

The Chancellor of the Exchequer, Rishi Sunak recently gave us the Government's view on the state of the UK economy and released his Autumn Budget statement.

There has been no doubt that the last 12 months have been difficult for the UK with the Chancellor announcing that the economy shrunk by 10% over the last 12 months.

Businesses have been working hard to adjust to the economic impact of COVID-19, working hard on how to keep their teams connected, and motivated, as well as staying profitable and managing debt.

He also set out measures that could have a direct impact on smaller and medium-sized businesses over the coming months and years.

Rishi Sunak, used the Autumn Budget and Spending Review to outline plans for growth and how the government will help with the cost of living to “build a stronger economy for the British people”

The key questions are how this Budget will balance these objectives, and what effect will this have on UK businesses?

The 2021 budget headlines

With an increase to corporation tax set for 2023, chancellor Rishi Sunak aimed his Budget towards boosting investment and targeting support for the retail, leisure and hospitality sector.

Here are the main headlines from the Budget Speech...

Big reform for business rates in England

The Chancellor delivered some large changes to the way business rates are calculated in England.

In his budget speech, Rishi Sunak declared that pubs, music venues, cinemas, restaurants, hotels, theatres and gyms would be able to claim a discount on their bills of 50%, in the 2022-23 tax year, up to a maximum of £110,000.

This is a tax cut worth an outstanding £1.7bn!

In addition to the Small Business Rates Relief, this means that more than 90% of all retail, hospitality and leisure businesses would see a discount of at least 50%

If you are a business owner in the retail, hospitality or leisure sector, please don’t hesitate to contact us if you would like to discuss in more detail how the recent budget announcements will affect your business and how you might be able to take advantage of the new measures.

Capital gains tax reporting changes

The reporting and payment window for capital gains on UK residential property disposals has been increased from 30 to 60 days. This will affect disposals that complete on or after 27th October 2021.

To anyone selling a property and up against tight deadlines to receive registrations this is welcome news owing to the practical difficulties.

Annual investment allowance extension

The £1m annual investment allowance will not end on 31st December 2021 as planned. Instead it will be in place until 31st March 2023. This is a decision that was welcomed by businesses that are looking to make capital investment in plant and machinery costing over £200,000.

The annual investment was set at £200,000 in 2016 and then temporarily increased to £1m in 2019 initially for a two-year period. This was then extended in November 2020 for a further year.

The measure is designed to encourage businesses to bring forward any capital expenditure plans into the qualifying period and there may be good reasons to do so.

Revaluations changed & Multiplier cancelled

Currently tied to the five-year valuation, in 2023 Business Rate revaluations will significantly change to a three-year cycle.

The Government have made this change to make the process fairer and more streamlines with more frequent property revaluations.

Financial Secretary to the Treasury Jesse Norman said:

Proposals set out in this consultation would mean that business rate valuations more quickly reflect how the economy is performing, making the system more accurate and responsive, while balancing the burden for ratepayers.

Additionally, the multiplier for business rates has been cancelled for 2022/23 a tax cut worth £4.6bn over the next five years.

The Review documents state that the freeze will ”save businesses in England £575 million over the next five years' and that “the government is also considering options for further Covid-19 related support through business rates reliefs.

In order to ensure that any decisions best meet the evolving challenges presented by Covid-19, the government will outline plans for 2021-22 reliefs in the New Year.”

National Living Wage increased

The National Living Wage for over-23s will increase by 6.6% to £9.50 an hour from April 2022. The rise means a full-time worker will get £1,074 extra a year before tax.

Chancellor Rishi Sunak said the rise "ensures we're making work pay and keeps us on track to meet our target to end low pay by the end of this Parliament".

Employers often worry that a higher minimum wage will lead to more unemployment, and that they will be forced to lay off workers in order to afford the increases.

However, independent experts maintain there has been little or no evidence of job losses as a result of rising minimum wage levels.

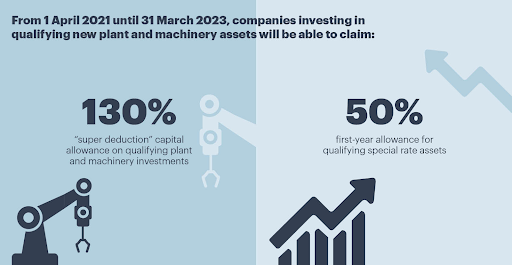

The super deduction

The rise in corporation tax will be tempered by what Sunak called a “super deduction” designed to spur investment. Instead of the proportional offset currently offered – or even full expensing, which would have seen profits reduced by the total cost of investment – taxable profits can be deducted by 130% of capital expenditure.

Sunak gave the example of a construction firm buying £10m of new equipment. The existing regime would have reduced its taxable income by £2.6m. With the super deduction, that reduction becomes £13m.

Find out more about super- deductions

HMRC is generous in what it considers qualifying expenditure and some examples are:

- Computer equipment and servers

- Tractors, lorries, vans

- Ladders, drills, cranes

- Office chairs and desks,

- Electric vehicle charge points

- Refrigeration units

- Compressors

Simplifying and reducing alcohol duties

The chancellor said he’s simplifying alcohol duty based around the principle of “the stronger the drink, the higher the rate”.

The number of main duty rates will be cut from 15 to 6. There’s also going to be a new relief for smaller producers of alcohol, including cider and sparkling wine, that builds on the existing small brewers relief.

Pub owners will also welcome a new relief which sees a cut to duty rates on draught beer and cider by 5%, taking 3p off a pint. However this new lower rate won’t come in until 2023.

Sunak says it’s the ‘biggest cut to cider duty since 1923 and the biggest cut to beer duty for 50 years.’ And he hopes this will ‘benefit community pubs, who do 75 percent of their trade on draught’.

How the Budget announcement could impact businesses.

As the COVID-19 government support measures come to an end, the pressure is on for UK businesses to recover and return to growth independently and for some this can prove difficult.

The Budget included some significant steps to recovery for the UK economy, most notably in adjusting business rates to allow relief on renewable energy and the extension of the super-deduction.

However, many businesses will still have to manage accrued debt that they may have built up during the past 18 months.

For this reason, it’s important that businesses develop a strategy to build resilience tailored to their specific needs. It is never too early to seek advice so that all options can be considered.

Addressing challenges as soon as they appear – and seeking any help needed – will maximise the amount of time management teams, their advisers and partners have to assess the issue and consider a range of possible options. This will in turn maximise their chances of recovery.

Contact us today to find out more about how we can support and strengthen your business.