Why it may be a good time to look at a bond for surplus cash?

One key reason is the low-interest rates. Directors could be increasingly concerned at poor returns available on deposit accounts.

However, despite this, they will have the comfort of knowing the funds will be available when they may be required. Therefore, a second key reason to consider a bond for surplus cash is that directors may be looking for any returns to be ‘smoothed’ and this could be possible in an insurance bond wrapper.

It’s important to remember the value of any investment can go down as well as up and your customer might get back less than they have put in.

In addition to the above here are some other reasons to consider why an investment in a bond could work for a company investment:

‘Basic rate credit’ mechanism – tax rules give recognition to the fact that UK bonds will have suffered life fund taxation. Although tax is treated as having been paid at 20% basic rate, the effective tax rate applying to the fund is always less than 20%. Dividends are exempt from tax; gains are taxed at 20%, and where certain capital gains are made on or after 1 January 2018, then indexation allowance will be applied, calculated up to December 2017.

- No ‘surrender penalties’ – although a bond is seen as a medium to long term investment, directors can access it without any penalty or having to leave it invested for a fixed term – they can get their money when they need it. Although the bond itself won’t suffer any surrender penalties, it’s important to remember that some funds might.

The combination of these factors means that an investment bond, with an appropriate underlying fund choice could be a more attractive investment opportunity for a company’s surplus cash rather than it sitting on deposit.

Impact on tax reliefs

There are two tax reliefs we'll look at in relation to a company investing in a bond. These are:

- Inheritance tax Business Property Relief (BPR)

- Capital Gains Tax (CGT) Business Asset Disposal Relief

Inheritance Tax BPR

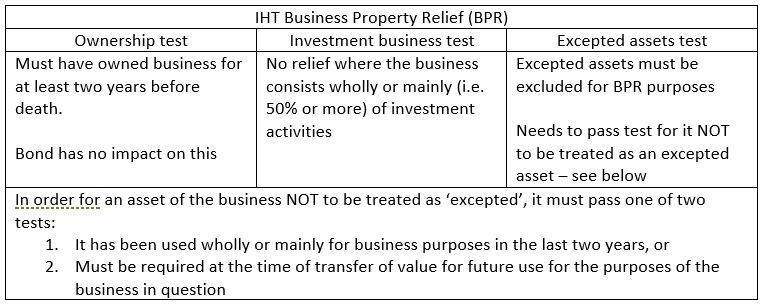

If a shareholder in a company dies, then three conditions need to be satisfied to obtain 100% relief:

1. The ownership test

2. The investment test

3. The excepted asset test

Each company’s circumstances will differ and therefore, will need to be evaluated individually. However, the key points are covered in this table:

Surplus funds held for no identifiable business purpose are likely to be treated as an ‘excepted asset’ whether in cash or whether invested – so switching from cash to bond (or vice versa) should have no impact on the availability of BPR.

CGT Business Asset Disposal Relief

For lifetime gains up to £1m, Business Asset Disposal Relief delivers a CGT rate of 10%. It is a very valuable relief. The company must be ‘mainly’ trading in the 24 months prior to sale. HMRC apply a 20% benchmark and therefore any investment activities must be kept within this to qualify for relief.

There is no single indicator when considering this 20% test. Instead the test should be applied ‘in the round’ – this means that there could be other indicators to consider when establishing if it’s a non-trading activity. You can find out more details on the HMRC website: www.gov.uk/hmrc-internal-manuals/capital-gains-manual/cg64090

In the case of surplus cash or an investment of those funds, it would seem logical to primarily focus on the asset base of the company when considering the 20% test. Ultimately, if a sale of the business is planned, then the accountant will monitor the position to ensure the 20% test isn’t breached in the 24 months prior to sale. This might simply involve spending or extracting some of those surplus funds.

Paying for advice

The best course of action is to speak to the company accountant to agree the most appropriate way. Companies are used to dealing with invoice payments so it may be that invoicing them for any adviser charge is the simpler approach rather than the insurance company facilitating the advice charge.

For more information or to discuss any of the issues raised in this article, please contact Marcus Pilkington on 0161 819 1311