The UK has left the EU and with the transition period coming to an end on 1st January 2021, it’s more important than ever, that businesses focus on planning for the impact that Brexit will have on their future.

With 2020 focusing on Covid-19 contingency planning, the deadline marking the end of the transition period for Brexit will soon be here, as many businesses are left wondering what the next steps are.

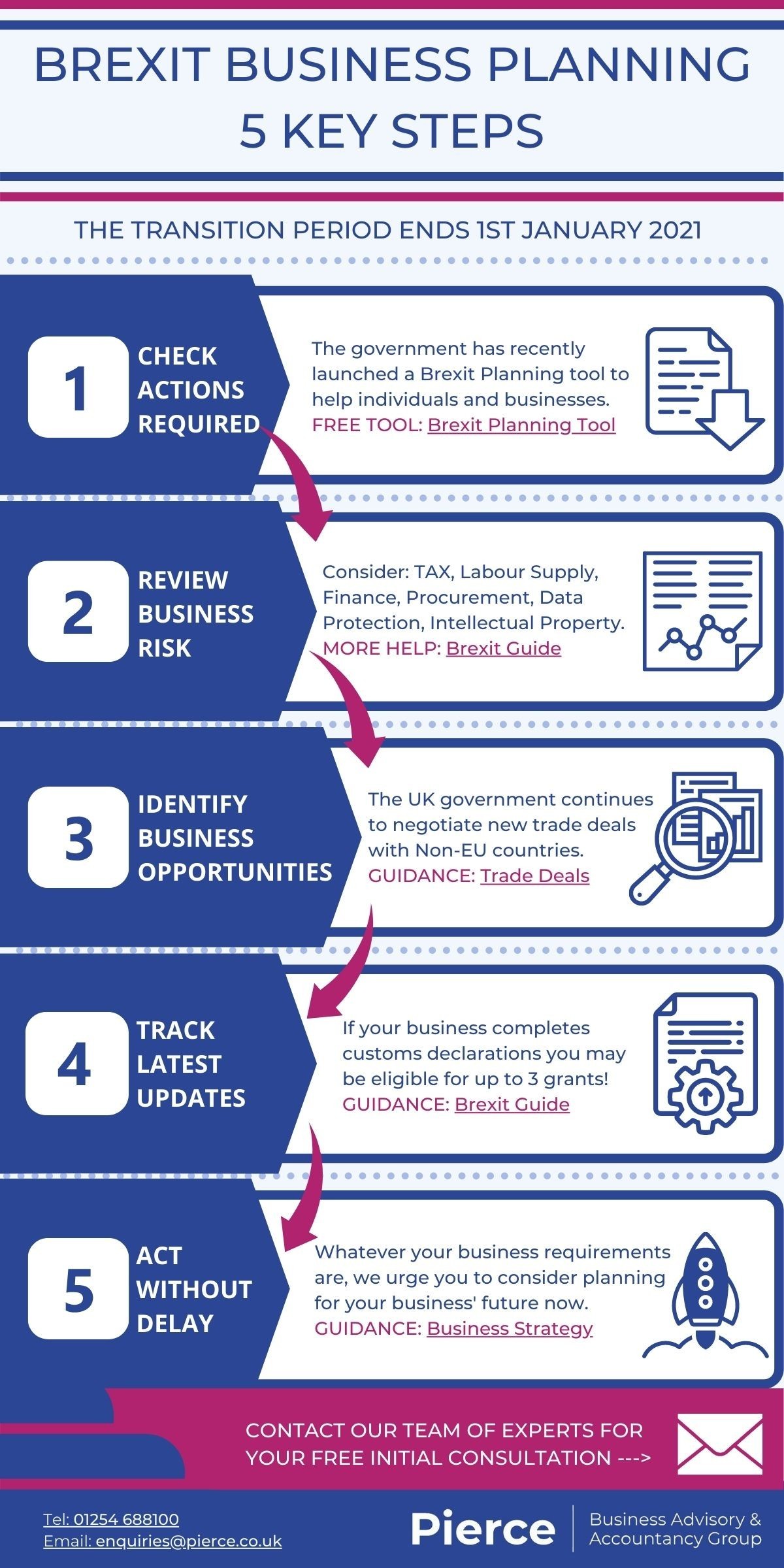

Within this article we have highlighted ways for preparing your business for Brexit through effective planning and helpful resources to ensure you’re ready for 1st January 2021.

1. Receive Personalised Actions

The government has recently launched a Brexit Planning tool to help individuals and businesses.

Using a traffic light system for the most important areas for you, this report can help businesses, families and individuals plan for their specific circumstances. This is a great starting point to prioritise what is important for your business.

2. Review Key Business Risks

With many areas of businesses being affected by the upcoming changes it is important to look at sectors that may specifically affect your business.

Considerations are as follows:

TAX - How exposed is your business and balance sheet to tax changes?

Labour supply - Would your business be impacted by restrictions on the free movement of workers between the EU and the UK?

Supply chain - Do you rely on goods being imported or exported from EU countries? This may impact you due to custom tariff, trade agreements or even speed of delivery.

Finance and the Economy - Do you trade or receive funding from the EU? Fluctuations in interest rates, exchange rates and funding may impact your bottom line.

Public procurement - Does your business take part in public procurement tenders? How dependent is your business on EU tenders?

Data protection - To what extent does your business process personal data within the EU, for example cloud data storage or payroll data?

Intellectual Property - Does your business use EU IP rights, such as EU trademarks, for protection in the UK? Licences and agreements may require modifying once the transition period ends.

Internal controls and compliance - Are your compliance policies, strategies or internal controls tailored to EU laws and regulations? Look to review and amend to accommodate potentially diverging EU and UK requirements.

Consider all sectors of increased risk so that mitigation measures can be implemented.

Don’t worry if you’re unsure, our team is here to help.

3. Identify Opportunities

There could be some great new opportunities for your business. As the final transition period comes to a close, the UK government continues to seek and negotiate a variety of new trade deals with Non-EU countries.

The government has signed mutual recognition agreements (MRAs) with Australia, New Zealand and the United States of America and is in ongoing discussions with Japan for a new bilateral agreement using the existing EU agreement as a base.

Find out the latest developments and talk to us about further opportunities for your business, we are specialists in accountancy and business services for manufacturing and engineering and can advise on import and export.

- Guidance on Trade Agreements with Non-EU countries

4. Track updates

We recommend keeping track of VAT, customs and tariff updates.

Importing Goods to the UK

From 1st January 2021 -

Introduction of UK Tariffs, this will effectively reduce the duty down on most imports, not just from those within the EU. Customs declarations and VAT / customs duty payments will be deferred for 6 months.

From 1st July 2021 -

Deferred customs duty will be payable.

Helpful information:

We recommend checking your method of importing to see whether deferred declarations are available to you.

Checker: UK trade tariffs from 1 January 2021

Flowchart: Importing goods from the EU after January 2021

Exporting Goods from the UK

From 31st December 2020 - The EU has indicated that without a negotiated Free Trade Agreement (FTA), it will impose full border controls and tariffs will be based on the World Trade Organisation rules.

HMRC currently issues Economic Operator Registration and Identification (EORI) numbers to all VAT registered businesses and auto-enrols them for Transitional Simplified Procedures (TSP).

Helpful Information

Guide: Prepare to export goods after 1st January 2021

Applying for Customs Declaration Grants

If your business completes customs declarations you may be eligible for up to 3 grants through the UK government.

Available grants are as follows:

Recruitment grant - £3,000 plus up to £12,000 to cover salary costs for each new or redeployed employee.

Training grant - Up to £1,500 for each employee on the course or up to £250 per employee on internally run courses.

IT improvements grant - 100% of the actual costs of externally-provided training for your employees, up to a limit of £1,500 for each employee on the course.

To obtain these government grants your business must:

- Have been established in the UK for at least 12 months prior to application

- Not previously failed to meet its tax obligations

Your business must additionally meet one of the following:

- Complete customs declarations on behalf of your clients

- Be an importer or exporter and complete or intend to complete declarations internally for your own goods

- Be an organisation which recruits, trains and places apprentices in businesses to undertake customs declarations

Pierce can help offer advice in securing grants for your business, contact our team to find out more.

Intercompany Transfers and Payments

Consider tracking intercompany transfers and cross-border payments, affected by changes to the following directives from the 1st January 2021.

EU Parent-Subsidiary Directive which allows EU groups of companies to pay dividends between associated companies without the need for tax to be withheld.

EU Interest and Royalties Directive which allows EU companies to make interest and royalty payments to associated organisations within the EU without needing to deduct tax from the payments.

If no agreement is reached by 31st December 2020, these transfers may be liable to a withholding tax, which could be in the range of 5-10%

5. Act now

Whatever your business requirements are, we urge you to consider planning for your businesses future now.

Planning for all eventualities, both best case and worst case scenarios is the best option to ensure you are prepared for the changes to come. Our business strategy services help clients’ to develop, measure and challenge their strategy for success.

For further assistance around Brexit Business Planning, please don’t hesitate to contact our experts, we are here to help you.